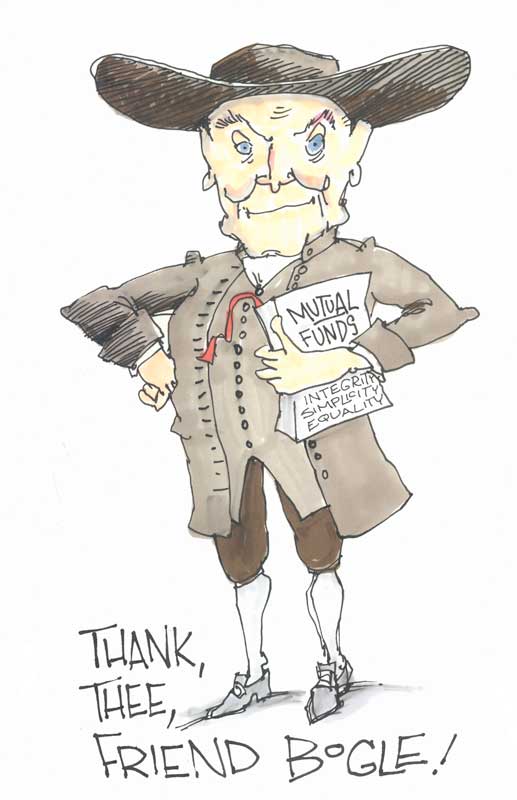

When thinking about who you know who most exemplifies Quaker values, perhaps John C. Bogle is not the name that first occurs to you. Yet the founder of the Vanguard Group who passed away last week at age 89 was a man whose beliefs in simplicity, equality, and honesty guided his life and his business. While Quakers talk about the need for jobs, he created a business that directly employs over 16,000 people and helps millions with modest earnings increase their savings.

In an interview in his Malvern, Pa., office in January 2017, Bogle, who attended his wife’s Presbyterian Church but maintained his Episcopalian faith, said that the Golden Rule was fundamental to his fiduciary responsibility: “Put your client’s interest above your own.”

Ruminating on his beliefs, Bogle said he “always had a lot of trouble with the realities of religion”:

What is real and what do you have to take on faith? It’s very hard for me to believe the body can be resurrected. The soul maybe. Why not? Since we don’t know exactly what the soul is. But the body! I’m looking out this window and I’m not seeing a whole lot of things moving up to heaven. So I’m a pretty realistic person. That conflicts with organized religion, but it doesn’t conflict with my faith. There’s something bigger and more important than we are sitting out there. We happen to call it God. That’s good enough for me.

Biblical references dot his writings. Bogle quotes from Psalm 118, “The stone which the builders rejected has become the chief cornerstone,” when he describes how his index fund idea was first dismissed as “Bogle’s folly” and yet, as he modestly said, “Now it’s taken over the world.”

How is he Quaker? Bogle’s basic idea for his index fund was “bringing simplicity to the business.” Instead of picking stocks and “beating the market,” his fund invested broadly across the market. As the market has risen over the decades, so have his investors’ shares. That kept management fees low.

In addition, shareholders—not the management—own the company. Where Ray Dalio, founder of Bridgewater Associates, made some $1.3 billion in 2017, Bogle was always paid a salary—a very good salary estimated in the low millions*—but peanuts in comparison to his peers. During his high-earning years, he regularly donated half that salary to philanthropic causes.

More fundamentally, though, he wrote an entire book on simplicity titled, Enough: True Measures of Money, Business, and Life. Bogle’s view is close to early Quakers’ idea of rightly prioritizing life’s activities. Bogle believed that “Simplicity (in managing money) gives people time to do other things. Other useful things.” His children, for example, remember that even during the height of his career, he would be home with them around the dinner table.

Bogle viewed his fund as a tool for equality both because its investment strategy was the same for all investors in the same fund and because his funds allowed people with small amounts to invest to share in the economy’s growth.

In talking about what’s good for the country, he said, “Anything that increases the racial divisions in our society or our world is bad for our society, bad for our economy, and bad for our financial markets. Anything that increases the gap between the wealthy and the poor is, in the long run, bad for our society, bad for our economy, and bad for our financial markets.” To address those divisions he said, “We (at Vanguard) stack the deck in favor of Main Street.”

Bogle didn’t spend much time second guessing himself but was honest about his shortcomings. When asked his main regret, he said, “One regret? I’m a little apologetic. We must try to help on racism. I don’t know what I’ve done on that.”

The critique Friends often made of him was on ethical investing. Bogle understood the wish to tailor investments to take into account environmental, military, or other concerns, but felt that doing so defeated the purpose of broad investments. And, he said, he once checked out the fund one of his critics who left Vanguard chose instead. He found it included Caesars Casino and pointed out gambling is hardly socially conscious (as Quakers once knew well).

Obviously, Bogle was bullish on business. Eastern Quakers, who tend to work in the nonprofit world, should open their ears. When his father lost his business, young Bogle went to work as a teenager and credits that experience for building his determination, self-reliance, and ability to get things done. He had a broad and favorable view of business:

One wants to be very careful about condemning business. The guy who runs the pizza shop is in business. The cart in front of the office where you can get a cup of coffee is a business—and a very creditable business, a hard-working business, a business that requires cheer all the time. That is a business as much as General Motors is a business. So I think . . . it’s terrible oversimplification to be down on business. It’s different than finance because most of finance is a waste. Most of business is not a waste. Let us not condemn.

But it is true that despite his admiration for Quakers, Bogle had a major shortcoming that would have prevented him from ever becoming a Quaker. He hated committees. He liked to decide things quickly and move on.

Still, over the course of his career, Jack Bogle has shared William Penn’s wisdom more widely than all of official Quakerdom has. He regularly quoted Penn in his books and speeches. Perhaps his favorite Quaker quote, often attributed to William Penn*, was: “I expect to pass through life but once. If therefore, there be any kindness I can show, or any good thing I can do to any fellow being, let me do it now, and not defer or neglect it, as I shall not pass this way again.”

I am grateful to have caught a glimpse of him as he passed by.

- An earlier version of this article incorrectly stated Bogle’s salary range ($30 to $50 million) as higher than the actual amount. A representative at Vanguard commented that his salary was never that high. At the time of his death, Bogle’s net worth was estimated at $80 million.

- “I expect to pass through this world…” has been attributed to any number of authors, including Stephen Grellet, William Penn, and Mohandas Gandhi. Wikiquote has traced it as far back as 1859, when it was published as an “anonymous proverb.” It is highly unlikely that Penn was its author.

An excellent piece, Signe: Jack was certainly a Quaker at heart even though not in practice.